CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

What is ECN trading?

ECN stands for ‘electronic communication network’ and refers to an automated component of trading that connects individual traders to liquidity providers including banks, brokerages and even other traders. This process provides access to the financial markets to individuals with any type of trading account and regardless of their balance size.

An ECN broker is usually a No Dealing Desk (NDD) broker, which means that the clients’ orders do not pass through a Dealing Desk, which enables execution in a direct connection between the parties.

First thing’s first, let’s get down to some detail

An ECN is an automated system that publishes orders entered by market participants directly to third parties and individual traders. Those orders are then automatically executed by matching buy and sell orders at the best price available.

ECN trading is an extremely efficient process using sophisticated technology. Linking all traders, large and small, directly with liquidity providers eliminates the need for a ‘middleman’ in your transactions.

ECN trading provides you with tighter spreads and greater depth in market pricing. This is because the ECN broker consolidates quotes from several participants in order to offer you the tightest bid/ask spreads available. This highly automated trading process results in real-time market quotes and speedy execution!

Envision it as a marketplace for broker’s clients to trade with each other, so traders like you can get the best possible offer at that moment in time.

How does an ECN work?

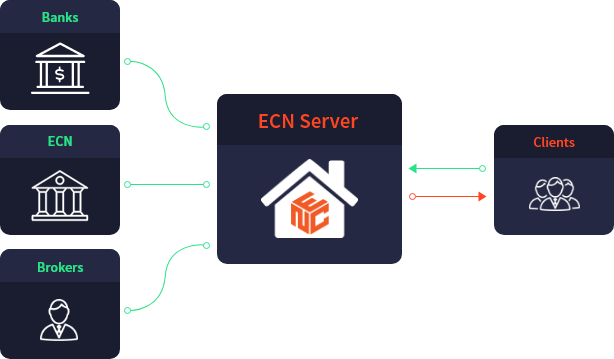

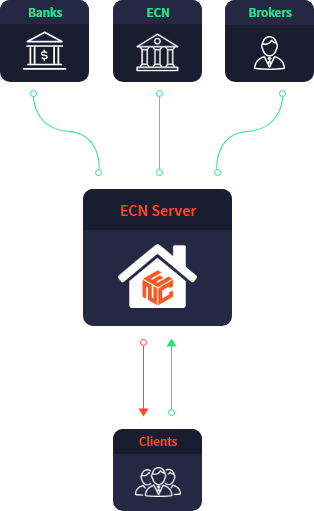

Check out our simple graphic below to understand how this complex automated process works:

- 1

Liquidity providers, such as global banks, enter either Buy or Sell orders into an ECN server. They then make those quotes available for their clients to trade with.

- 2

On the other side, traders get access to different quotes for execution and are shown the best bid and ask prices available in the market. The traditional ‘middleman’ in the trading process is eliminated.

- 3

An ECN broker helps clients enter the currency markets directly by matching ECN trades between market participants and then passing the orders to the liquidity providers.

What is an ECN Forex Broker?

In summary, a forex ECN broker uses the MT4 or MT5 trading platforms, and manages ECN trading as a ‘hub’, where all the major market players act as a liquidity source. The broker uses this network to provide its clients with direct access to other participants in the market.

By way of a reminder, the forex market is by some distance the largest traded global market— and the most accessible market in the world:

- The daily volume traded in forex market stands at over $5 trillion, which is 50x larger than that traded by the New York Stock Exchange

- Nearly 90% of forex trading is speculative trading

- Over 85% of forex transactions take place solely in the majors

- Forex markets are open 24/5, from 5pm EST Sunday to 4pm EST Friday

- Visit our website here to learn more about what forex is and how it works

ECN Fees

One thing to note is that ECN brokers avoid wider spreads that are common with a traditional broker. However, the ECN broker will benefit from commission fees per transaction – this is a fixed, transparent commission.

Market execution

Your ECN broker automatically matches and executes the orders requested at the best available prices. You get immediate confirmation and, as there is no dealing desk involved, there are no re-quotes!

Low spreads

Compared to standard brokers, your ECN brokerage can offer much tighter spreads as there is no ‘middleman’. Price quotations are gathered from numerous market participants, meaning ECN trading avoids wider spreads.

Anonymity

Trading activity with an ECN broker is completely anonymous. Prices reflect real, live market conditions at that time with the ECN providing a level of privacy to those who need it, such as those executing large orders.

Fixed commission

The broker will charge a fixed commission every time you trade, as this is their profit. That said, it is certainly more transparent than the costs involved when using a market marker.

Variable spreads

Live prices are constantly moving and especially when trading sessions overlap, a true ECN broker may offer floating spreads.

Execution risk

As with any financial trading, there is risk involved if the assets being traded are illiquid i.e. if it’s easy to exit the positions held.

The introduction of ECN trading was a milestone for the modern forex industry. With direct access to liquidity providers, automatic order execution and matching, it has become the way forward for many forex traders around the world.

FXTM ECN Account

Set up an ECN forex account with FXTM today